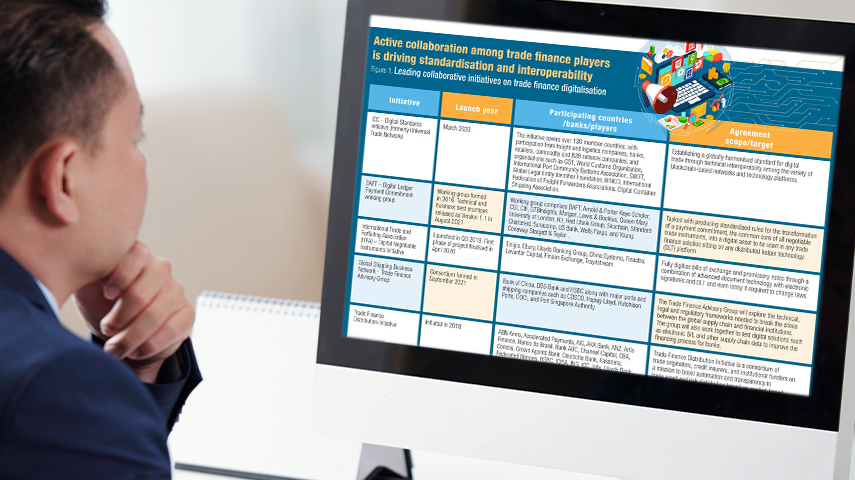

As the trade finance industry collectively progresses to address challenges around digital fragmentation and isolation, adoption of standard solutions and well-established legal frameworks along with technology as an enabler will play critical roles in truly digitalising trade.